The resources below are only available to Members of MHEDA. If you are not a Member and want to learn more about joining, click here.

Economic Advisory Report

During uncertain times, look to MHEDA for economic data, guidance and insight. MHEDA Members have exclusive access to a FREE, quarterly report, produced by experts at ITR Economics. This report is generated specifically for MHEDA Members and provides you with clear, actionable data and insights. This is an excellent tool for you and your leadership team to utilize as you plan for shifting economic conditions. Download your report today and share with your team.

Report Highlights:

- Updated Quarterly

- FREE for MHEDA Members

- Includes data trends, moving averages and totals;

- Describes data on future demand for your products and services;

- Uncovers foresight of the expected growth and contraction in the market;

- Provides growth rate forecast for 2024, 2025, and 2026;

- Offers advice and insights for how to manage during four different Business Cycle Phases (Recovery, Accelerated Growth, Slowing Growth and Recession.)

- Includes strategic insights for leaders on seven key markets (see image below);

- And so much more!

Order Free Report (requires member login)

Listen to the MHEDA podcast for 2024 Q1 report below.

Q4 2023 Key Insights (Report Published October 27, 2023)

Ten Key Insights from the Q4 2023 MHEDA/ITR Report: “The State of the Economy Looking Forward”

-

While many headlines suggest the US economy may be able to avoid a recession after all, our (ITR) analysis suggests that is not likely. While the leading indicators remain mixed, the most convincing evidence still points toward a mild recession with a late-2024 low.

-

Annual US Material Handling Equipment New Orders totaled $47.9 billion, up 10% from the same year-ago level.

-

ITR expects Material Handling Equipment New Orders to rise into early 2024. New Orders have been relatively resilient to downside economic pressures such as elevated interest rates. We are forecasting annual New Orders decline from the first half of 2024 into early 2025.

-

On the leading edge of the economy, we are seeing green shoots of recovery in single-family residential construction. The tight supply of existing homes supports an underlying need for new construction, but affordability remains a constraint largely due to elevated interest rates.

-

While it can be daunting to face a year of contraction, recovery in the housing market serves as an encouraging reminder that this decline is temporary.

-

The ongoing United Auto Workers (UAW) union strike may impact current Production, as negotiations are ongoing. If successful negotiations lead to a prompt resolution, the current outlook will remain unchanged. We are closely monitoring the situation, and we will revise our forecast if needed based on further developments.

-

Decline in Annual Production is imminent. US exports are sharply decreasing, as many of the US trade partners are also are on the back side of the business cycle.

-

Real incomes are rising, and we expect inflation to diminish further and the labor market to remain relatively strong. Together, this should put US consumers, who are the backbone of the economy, in a position to support rise for the macroeconomy in 2025.

-

Rise will resume for most industries in 2025. Opportunity can be found in countercyclical and nondiscretionary markets; those which have received federal funding, such as semiconductors and renewables; and younger industries, such as e-commerce.

-

2025 will generally be a year of moderate rise; a return to record highs will likely occur beyond the forecast range, during the second half of the decade.

Takeaways for Your Business:

-

Utilize our market forecasts for your planning and have contingency plans for both the upside and downside.

-

In addition, think back to previous economic booms – what do you wish you had done during the downturn to set your business up for success? Time those actions so you can capitalize on the general rise during 2025 and much of the second half of this decade.

-

Look for ways to lean into your competitive advantages and take the time to address any competitive disadvantages you may have. Extra time may afford an opportunity for system upgrades or efficiency improvements.

-

Lastly, we expect the labor market to remain relatively tight. Look to retain and cross-train key, high-performing employees to keep the business running, and look for ways to minimize your dependency on labor through efficiency gains.

Q3 2023 Key Insights (Report Published July 25, 2023)

Ten Key Insights from the Q3 2023 MHEDA/ITR Report: “Where We Are”

- Downward pressures are intensifying across a wide breadth of markets, and we are seeing more growth rates drop to near or below zero.

- The single-family residential construction market has been bludgeoned by elevated interest rates, with annual US Single-Unit Housing Starts down 22.4% from one year prior.

- Adjusted for inflation, annual US Total Retail Sales are virtually flat.

- The industrial sector is still rising, but the growth is being driven by the oil and gas sector; the manufacturing and utilities segments are declining.

- Nonresidential construction, which lags other sectors of the economy, is accelerating, but elevated interest rates, tightening credit standards, and a weakening economy will likely discourage new projects.

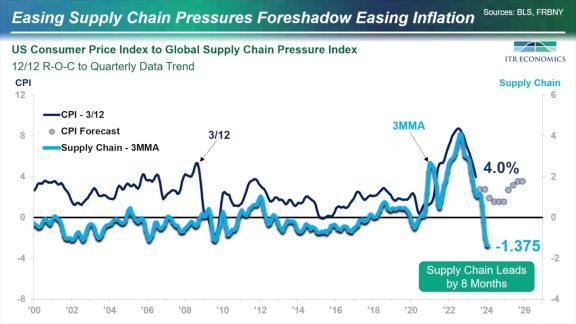

- US Consumer Prices inflation has declined from a peak of +9.1% in June 2022 to +3.0% in May, but the Federal Reserve is maintaining a hawkish tone.

- Meanwhile, the more volatile US Producer Prices inflation has moved from +18.3% to -3.1% over that same time.

- It will be beneficial to keep more cash on hand, both to shore up your financial position and position yourself to take advantage of deals at the bottom of the cycle, which will occur around late 2024 for most markets.

- US Material Handling Equipment New Orders in the 12 months through May totaled $46.5 billion, 9.4% higher than the year-ago level. A revision to the historical New Orders data by the US Census Bureau necessitated a new outlook.

- Inflation has eased significantly; Prices rise is unlikely to contribute substantially to Retail Sales growth in at least the near term. However, we do not expect a return to the low inflation of the 2010s. These trends are likely to impact dollar-denominated Retail Sales.

Takeaways for Your Business:

- Take steps to prepare for upcoming contraction, though the magnitude will vary by industry and geographic region.

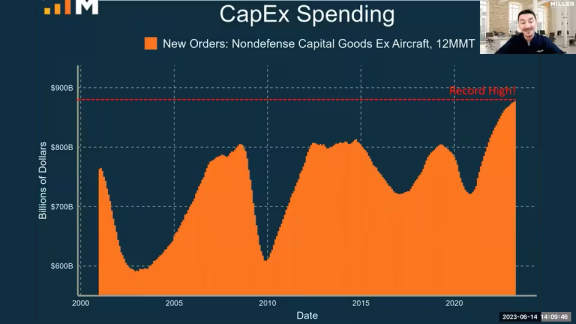

- Revisit your capital expenditure plans, though investments to improve efficiencies or reduce labor dependence may still be advisable.

- Have cash on hand to smooth out your finances.

- Keep in mind that lending criteria will likely be stricter as we move along the back side of the business cycle.

Q2 2023 Key Insights (Report Published April 28, 2023)

Ten Key Insights from the Q2 2023 MHEDA/ITR Report: “Recession in 2024”

- The bad news: ITR is forecasting worsening economic conditions as this year progresses and recession in 2024.

- The good news: ITR expects the upcoming recession to be relatively mild.

- For many companies that trend with the industrial sector, we are expecting a relatively mild downturn, more akin to 2015-16 than the Great Recession.

- Consumer balance sheets remain solid, with relatively low debt-to-income ratios, muted credit delinquency rates, and rising inflation-adjusted income.

- The trend of onshoring and nearshoring manufacturing facilities to strengthen supply chains is likely to persist, providing new opportunities for domestic manufacturers.

- US Material Handling New Orders will be relatively flat this year.

- US Overall Wage Growth was at 6.4% in March, having declined slightly from a record high of 6.7% in late 2022. Ongoing and expected rise in labor costs will push businesses toward automation, somewhat blunting the impact of macroeconomic decline on New Orders over the coming business cycle.

- US Food Production in the 12 months through March was 1.5% above the year-ago level.

- While annual Retail Sales will rise through 2025, the pace of rise will decrease into the end of 2024, in concert with the anticipated macroeconomic recession that year.

- Leading indicators point to tougher economic conditions in the coming quarters. Monitor your company’s quarterly and annual rolling rates-of change to assess how you are being impacted.

Takeaways for your business:

- Know your customers and your market;

- Promote your business’s competitive advantages;

- Re-examine any planned capital expenditures;

- Make sure you have sufficient cash on hand;

- Do not fall into the rabbit hole. In the long term, we expect the US to be well-positioned as a place for business.

Q1 2023 Key Insights (Report Published February 1, 2023)

Ten Key Insights from the Q1 2023 Report: “What A Yield Curve Inversion Means for You”

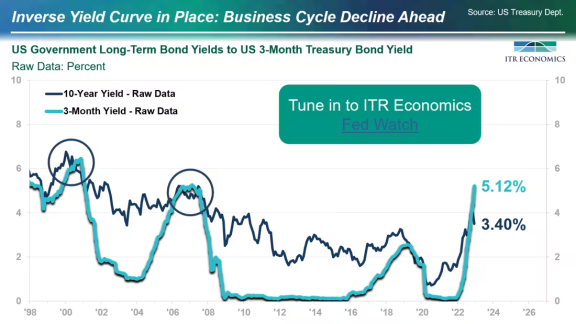

- According the closely monitored data, there is an 88% probability that a recession is coming.

- Expected decline throughout 2024.

- Three main tailwinds – reshoring, backlogs, and a solid consumer balance sheet – will keep the recession relatively mild.

- It will be especially important to understand the degree to which your business will (or will not) be impacted by a macroeconomic recession. Use the forecasts in this report to help.

- Take this as an opportunity to upgrade your talent pool in preparation for recovery and rise starting in 2025.

- In spite of this, the labor market and consumer balance sheets look very strong, offering upside risk.

- What can you do amid the uncertainty? First and foremost, make a plan and work the plan.

- Get your employees excited and focused on implementing those plans; but be ready to adjust your plans as things develop.

- Monitor your cash flow more carefully than before.

- Lastly, lead with confidence and be opportunistic. Your competitors may go into panic mode. Do not follow them there.

Report Summary Excerpt:

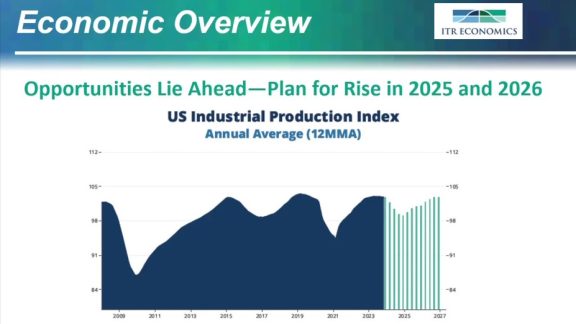

“Rain or shine, we constantly monitor our system of leading indicators for signs of improvement or

deterioration. In the last quarter, we’ve seen broad-based weakness, coupled with a new signal: short-term interest rates, as measured by 3-month Treasury yields, are now higher than long-term interest rates, as measured by 10-year Treasury yields. This so-called “inverted yield curve” signals an 88% probability that recession is coming for US Industrial Production; the Federal Reserve has raised short-term interest rates too far, too fast.

We lowered our annual average US Industrial Production forecast by a slim 0.4% for 2023. Instead of the mild growth (+1.6%) previously forecast, we now expect activity to be virtually flat for 2023 (+0.1%) relative to 2022, with decline developing late in the year. 2024 is impacted more significantly. Prior to the extremely sharp and fast rate hikes by the Fed, we had been expecting growth for 2024. Now we expect decline to extend throughout 2024, with the year coming in 2.3% below the 2023 average, as it typically takes just over a year for yield curve inversions to translate to recession.”

Order Free Report (requires member login)

DSC (Distributor Statistical Comparison) Report

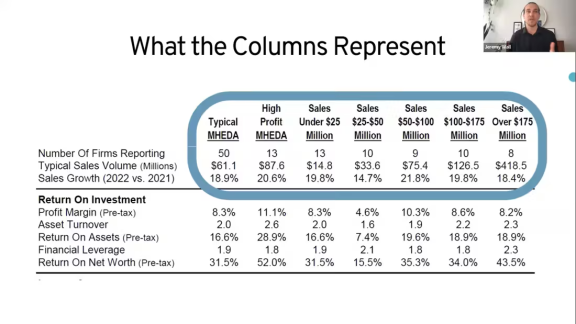

MHEDA’s DSC Report is a financial benchmarking study that annually provides key insights into exactly how the “high-profit firms” generate better profit numbers. It focuses intently on the three profit drivers: growth, gross margin and expenses. The report, available for Industrial Truck, Storage & Handling and Systems Integrators, provides clear evidence as to how small differences in a few areas translate directly into higher levels of profitability. The DSC Report is a summary of dealer member financial data presented in tables and graphs designed to provide a comprehensive guide for analyzing profitability. Member Cost: $500

Learn More

Purchase 2023 Report (requires member login)

Podcasts

Economic Advisory Podcasts

Don’t have time to read an economic report? Listen to the podcast! In approximately 10-minutes you will hear the critical highlights of the economic report via podcast.

January 31, 2024Duration: 15:36

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Listen to Podcast

October 27, 2023Duration: 18:32

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Listen to Podcast

July 25, 2023Duration: 19:34

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Listen to Podcast

April 28, 2023

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Listen to Podcast

February 1, 2023Duration: 10:54

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Listen to Podcast

MHEDA-TV Videos

January 31, 2024Duration: 15:36

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Watch Video

October 27, 2023Duration: 18:31

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Watch Video

July 25, 2023Duration: 19:34

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Watch Video

June 15, 2023Duration: 43:15

A slowing macro economy is a headwind for investment, affecting everything from capacity planning to capital expenditures and inventory levels. The pandemic-era swings in both supply and demand are calming, […]

Watch Video

June 9, 2023Duration: 56:07

MHEDA has been dedicated to offering benchmarking resources to help members understand their profitability level and how they compare to their competition. The DSC Survey & Report is a tool […]

Watch Video

Articles from The MHEDA Journal

April 8, 2024

MHI Forecast reports that 2024 is all about measured optimism.

ITA Forecast reports on What cycles will we see in 2024?

CEMA Forecast reports on The path forward this year is nothing short of exciting.

Read Article

March 6, 2024

MHEDA suppliers across North America share their thoughts on the year ahead and the obstacles and opportunities they foresee playing important roles for both them and the broader economy.

Read Article

February 20, 2024

As we enter 2024, Beaulieu encourages MHEDA members to not shy away from intimidating words like “recession,” but to instead take control of processes and planning. Beaulieu notes how vital it is that businesses invest in themselves and their people. He also informs members on what they can expect next.

Read Article

February 2, 2024

The following are responses from MHEDA distributors and integrators across North America about what they forecast for 2024. They share their thoughts on the year ahead and the obstacles and opportunities they foresee playing important roles for both them and the broader economy.

Read Article

January 31, 2024

MHEDA DSC (Distributor Statistical Comparisons) Report examines and contrasts MHEDA distributor member companies according to their size, line of business and location. John Gelsimino and Tom Albero share their expertise on the DSC Survey and ensure members are well-informed and equipped to use this incredible resource.

Read Article