The resources below are only available to Members of MHEDA. If you are not a Member and want to learn more about joining, click here.

Economic Advisory Report

During uncertain times, look to MHEDA for economic data, guidance and insight. MHEDA Members have exclusive access to a FREE, quarterly report, produced by experts at ITR Economics. This report is generated specifically for MHEDA Members and provides you with clear, actionable data and insights. This is an excellent tool for you and your leadership team to utilize as you plan for shifting economic conditions. Download your report today and share with your team.

Report Highlights:

- Updated Quarterly

- FREE for MHEDA Members

- Includes data trends, moving averages and totals;

- Describes data on future demand for your products and services;

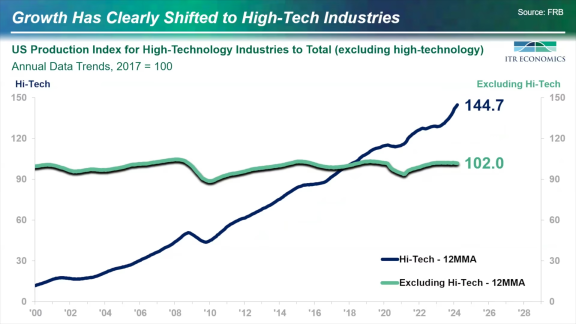

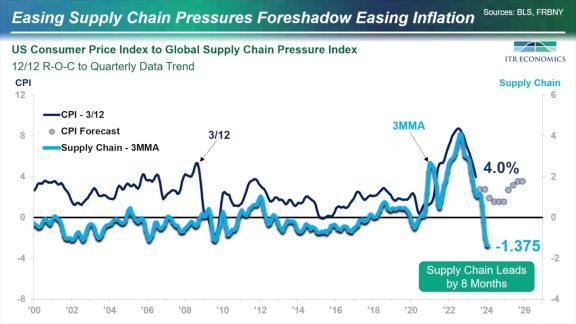

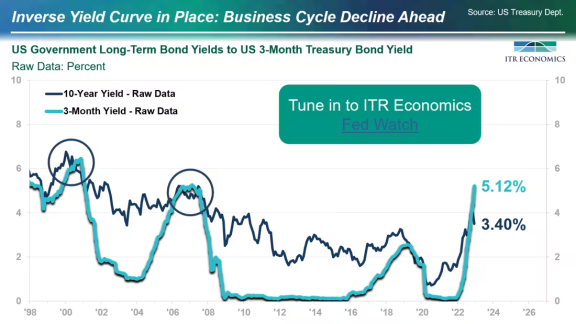

- Uncovers foresight of the expected growth and contraction in the market;

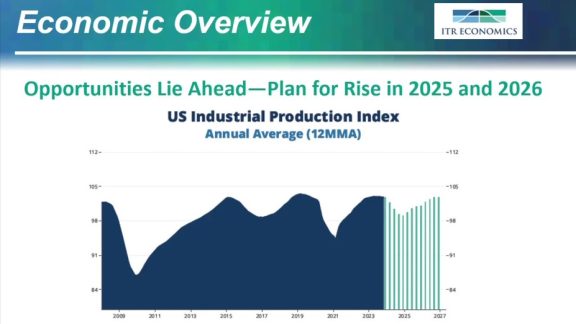

- Provides growth rate forecast for 2024, 2025, and 2026;

- Offers advice and insights for how to manage during four different Business Cycle Phases (Recovery, Accelerated Growth, Slowing Growth and Recession.)

- Includes strategic insights for leaders on seven key markets (see image below);

- And so much more!

Order Free Report (requires member login)

Listen to the MHEDA podcast for 2024 Q2 report below.

Order Free Report (requires member login)

DSC (Distributor Statistical Comparison) Report

MHEDA’s DSC Report is a financial benchmarking study that annually provides key insights into exactly how the “high-profit firms” generate better profit numbers. It focuses intently on the three profit drivers: growth, gross margin and expenses. The report, available for Industrial Truck, Storage & Handling and Systems Integrators, provides clear evidence as to how small differences in a few areas translate directly into higher levels of profitability. The DSC Report is a summary of dealer member financial data presented in tables and graphs designed to provide a comprehensive guide for analyzing profitability. Member Cost: $500

Purchase 2023 Report (requires member login)

Podcasts

Economic Advisory Podcasts

Don’t have time to read an economic report? Listen to the podcast! In approximately 10-minutes you will hear the critical highlights of the economic report via podcast.

Economic Advisory Report: April 2024

May 7, 2024Duration: 12:48

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: January 2024

January 31, 2024Duration: 15:36

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: October 2023

October 27, 2023Duration: 18:32

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: July 2023

July 25, 2023Duration: 19:34

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: April 2023

April 28, 2023

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

MHEDA-TV Videos

Economic Advisory Report: April 2024

May 7, 2024Duration: 12:48

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: January 2024

January 31, 2024Duration: 15:36

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: October 2023

October 27, 2023Duration: 18:31

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

Economic Advisory Report: July 2023

July 25, 2023Duration: 19:34

This quarterly economic report, published by ITR Economics, features data specifically for the material handling industry to assist MHEDA members plan for the year ahead. The full detailed report is […]

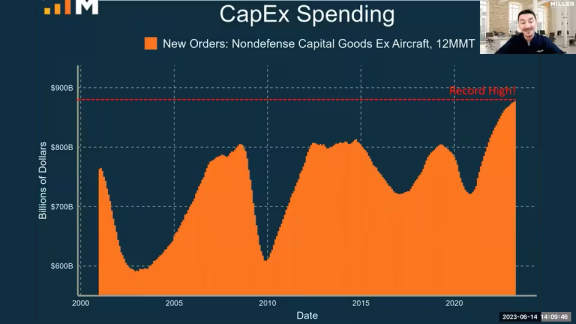

Macroeconomics: B2B Capex, Inventories, and Investment Considerations

June 15, 2023Duration: 43:15

A slowing macro economy is a headwind for investment, affecting everything from capacity planning to capital expenditures and inventory levels. The pandemic-era swings in both supply and demand are calming, […]

Articles from The MHEDA Journal

Economic Forecast: MHI – ITA – CEMA

April 8, 2024

MHI Forecast reports that 2024 is all about measured optimism. ITA Forecast reports on What cycles will we see in 2024? CEMA Forecast reports on The path forward this year is nothing short of exciting.

Economic Forecast: Suppliers

March 6, 2024

MHEDA suppliers across North America share their thoughts on the year ahead and the obstacles and opportunities they foresee playing important roles for both them and the broader economy.

Economic Forecast: 2024: The Year of Movement and Investing

February 20, 2024

As we enter 2024, Beaulieu encourages MHEDA members to not shy away from intimidating words like “recession,” but to instead take control of processes and planning. Beaulieu notes how vital it is that businesses invest in themselves and their people. He also informs members on what they can expect next.

Economic Forecast – Distributor/Integrator

February 2, 2024

The following are responses from MHEDA distributors and integrators across North America about what they forecast for 2024. They share their thoughts on the year ahead and the obstacles and opportunities they foresee playing important roles for both them and the broader economy.

Money Matters: Elevate Your Bottom Line With the DSC Report

January 31, 2024

MHEDA DSC (Distributor Statistical Comparisons) Report examines and contrasts MHEDA distributor member companies according to their size, line of business and location. John Gelsimino and Tom Albero share their expertise on the DSC Survey and ensure members are well-informed and equipped to use this incredible resource.